On Tuesday, the Nifty and the Sensex advanced, however, the broader market continued to decline in the Indian stock market. The trading was volatile and a few large-cap stocks from information technology, financial services and banking supported the market. The biggest losses were registered in PSU banking as well as metals.

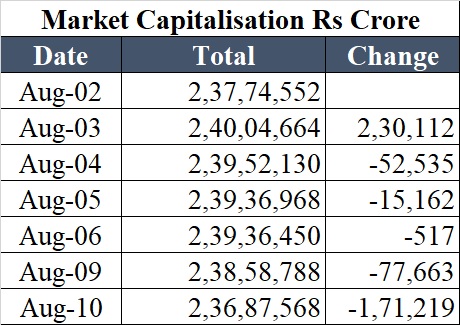

The overall texture of the market seems to be weak as only a few stocks gained while most declined. Even the market capitalisation declined for the fifth session in a row. For the day, market capitalisation declined by Rs1.71 lakh crore.

During the day, both Nifty and Sensex scaled new historic highs but profit booking at higher levels in metals and other heavyweights caused declines.

Compared to an all-time high of 54,779 the Sensex closed the session at 54,555, gaining 152 points. The Nifty scaled a new high of 16,359 before closing at 16,280, an increase of 22 points. In the index heavyweights HDFC, Bharti Airtel, Infosys and Kotak Mahindra gained the most while ITC, Tata Steel, State Bank of India and Power Grid declined.

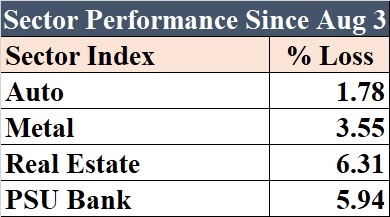

Both benchmark indices are displaying a perfect script of buying at declines and booking profit at the higher levels. However, on the sectoral front, the situation is different. The biggest driver of the market momentum so far Auto, Metals, Real Estate and Public Sector Banks are losing their ground. All four sectoral indices have declined since the benchmarks attained an all-time high on August 3.

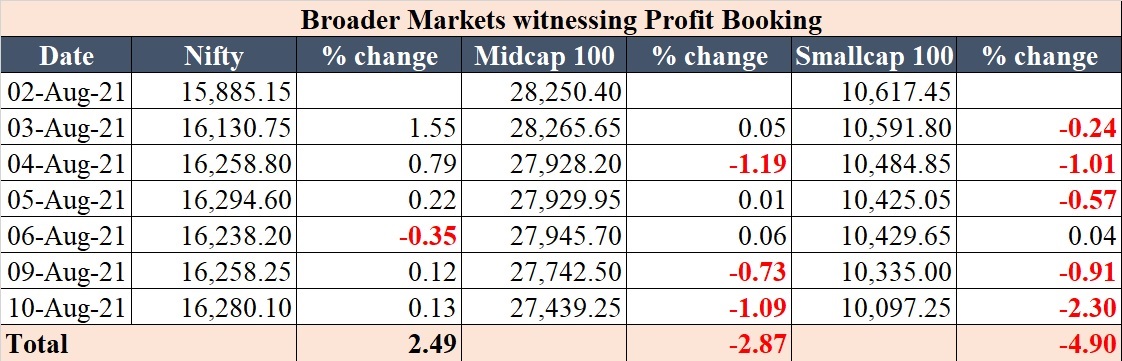

Benchmarks gain, broader market down

Indian stock market is giving a mirage for the last few days. Compared to gains in the benchmark, all other indicators are pointing at profit booking and declines. Compared to a gain of 2.49% in the Nifty, the Nifty Midcap100 index is down 2.87% while Nifty Smallcap 100 index is down by 4.90 for August.

The Nifty and the Sensex recorded historic highs on August 3 and with that, the investors’ wealth (as measured in terms of market capitalisation) also crossed an all-time high of Rs240 lakh crore. However, since then with more shares declining every day compared to those making advances, the wealth has eroded by Rs3.17 lakh crore, including Rs1.71 lakh crore on Tuesday.