For the third session on the trot, benchmark indices – Sensex and Nifty – closed with gains and ended the historic highs. On the day of the weekly expiry of the derivatives, the Indian market closed with a downtick, reached a pick on buying interest and gave away half of its gains. The mood in the market was cautious ahead of the RBI’s monetary policy statement on Friday.

However, the market momentum was largely driven by the scepticism surrounding the fate of Vodafone Idea Limited, the telecom arm of Aditya Birla group. Shares of Vodafone’s rivals jumped, however, lenders and group firm’s shares declined on profit booking.

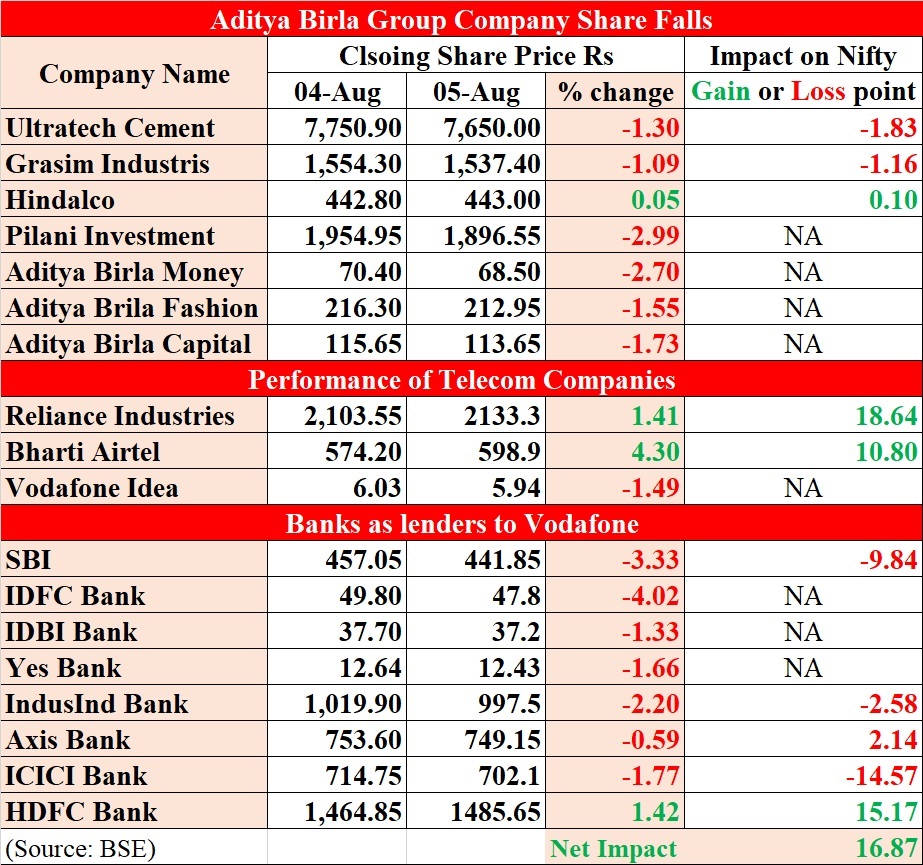

At the close, BSE Sensex gained 123 points to 54,492 while Nifty advanced 36 points to 16,294. Both the indices reached intraday highs of 54,717 and 16,349 respectively. In the index heavyweights Reliance, Bharti Airtel and HDFC Bank gained the most, however, SBI, Axis Bank, Ultratech Cement, Indusind Bank declined the most.

Most sectoral indices closed with losses for the day. The highest decline was recorded in Banking, Realty, Media, PSU Banks while Metals and IT advanced. Like the previous session, the broader market continued to decline with 2031 shares closing down and 1197 ending with gains. The small-cap index closed in the red while the midcap was marginally up. A decline in the overall market cap of the stock for Thursday indicated profit-booking by traders at high levels.

Investors react to Birla’s resignation

On Wednesday evening, Kumar Manglam Birla, one of the richest in India and the head of the diversified Aditya Birla group stepped down from the board of the beleaguered Vodafone India resulting in panic surrounding the future of the country’s third-largest mobile service provider. The company owes Rs1.80 lakh crore to the government, bankers and other lenders. With no new equity infusion, the reluctance of new investors joining in, concerns are increasing around the survival of Vodafone Idea, once the biggest mobile brand in the country.

The resignation from Birla sparked selling pressure on all group companies, except Hindalco Industries. Losing almost a quarter in the last three days, shares of Vodafone Idea were sharply down, however, it recovered towards the close and ended with 1.49% losses. Shares of all banks that have exposure to the telecom company were down except, HDFC. Despite reporting better than expected results shares of SBI, Axis Bank, Indusind Bank all closed with declines.

Meanwhile, two of the large competitors Bharti Airtel and Reliance Industries (owner of Reliance Jio) gained. Shares of Bharti Airtel gained 4.30% and Reliance closed the day with a 1.41% up move.