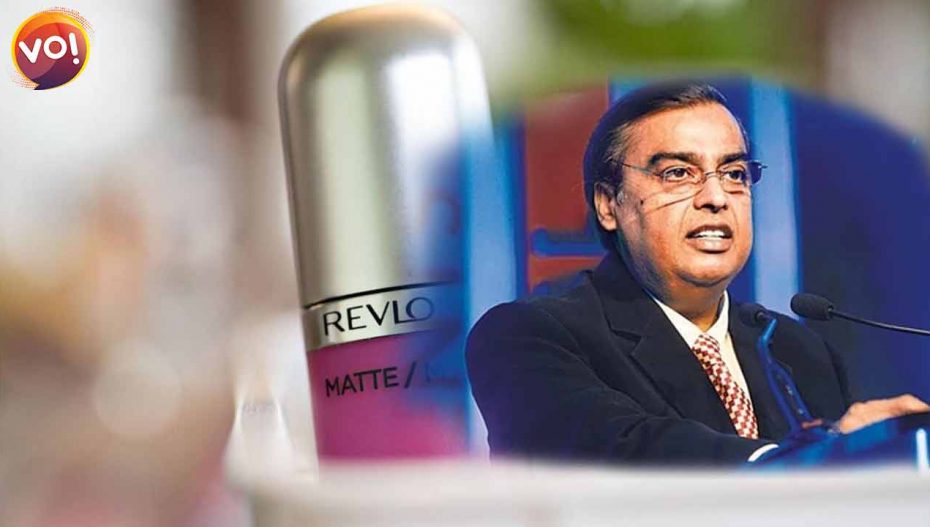

The all-rounder behemoth Reliance Industry is considering buying Revlon Inc. in the United States, days after the cosmetics company filed for bankruptcy. Expanding its area into fashion and self-care, the oil giant is now pushing its market to the cosmetics industry.

Revlon filed for Chapter 11 bankruptcy protection in the United States on June 14 to manage its debts, which amounted to between $1 billion and $10 billion.

A crucial seller in the global market since its foundation in 1932, the company could not keep up with the rapidly changing times and demands of the cosmetics industry and its customers. Ultimately, Revlon lost its market share to rivals like Procter & Gamble and new celebrity-led brands like Kylie Cosmetics.

But, its problems only increased during the pandemic, when the substitute for lipstick became a medical-grade mask. In the initial year of the pandemic, the sales dropped to 21%. However, it saw a rebound of 9.2% after the widespread vaccine.

Barely escaping bankruptcy in 2020, by persuading bondholders to extend the maturity debts, the global supply chain disruptions were too much for the company to stand. In the quarter ending in March of the current year, their sales rose approximately 8%. But, they were still behind its pre-pandemic level of over $2.4 billion a year.

Once the court approval comes out, the company said it would receive $575 million in financing from its current financial lenders.

Debra Perelman, the Revlon CEO since 2018, said, “The filing will allow Revlon to offer our consumers the iconic products we have delivered for decades. It will also provide a clearer path for our future growth.”

Revlon shares increased from 20% to $2.36 in premarket trade after the news. At the same time, reliance rose to 1.9% in the market in Mumbai.

Read also: Tesla Linked To 70% Car Crashes Involving Auto-Pilot