At a time when domestic consumption is falling in the country, an unprecedented price rise on two key fuels – petrol and diesel –may be counterproductive. Another threat due to record high prices is inflation. At a time when economic recovery is fragile and there is a looming threat of the third-wave of Covid19, higher prices could restrain the Reserve Bank of India (RBI).

Even the RBI has expressed its concern over higher fuel prices. “The rising trajectory of international commodity prices, especially of crude, together with logistics costs, pose upside risks to the inflation outlook. Excise duties, cess and taxes imposed by the Centre and States need to be adjusted in a coordinated manner to contain input cost pressures emanating from petrol and diesel prices,” the Minutes of the Monetary Policy Committee Meeting of June noted.

“Our calculations show that with every 10 per cent increase in petrol pump prices (Mumbai) there is 50 bps increase in Consumer Price Inflation,” group chief economic advisor to the State Bank of India group, Dr Soumya Kanti Ghosh says. He adds that for the current financial year, the GDP outlook will be impacted by the trajectory of international commodity prices which have risen sharply during the year. Further, the pass-through impact of higher commodity prices will be visible in domestic prices thus impacting consumption during the year.

In the last 14 months to June, petrol prices have gone up by 42 per cent and diesel by 43 per cent, the biggest reason why consumer inflation is at an elevated level.

“As prices of essential goods increase and households spend more there is less left for discretionary expenditure. Hence there can be some cut back on spending at the margin,” says the chief economist of Care Ratings, Madan Sabnavis.

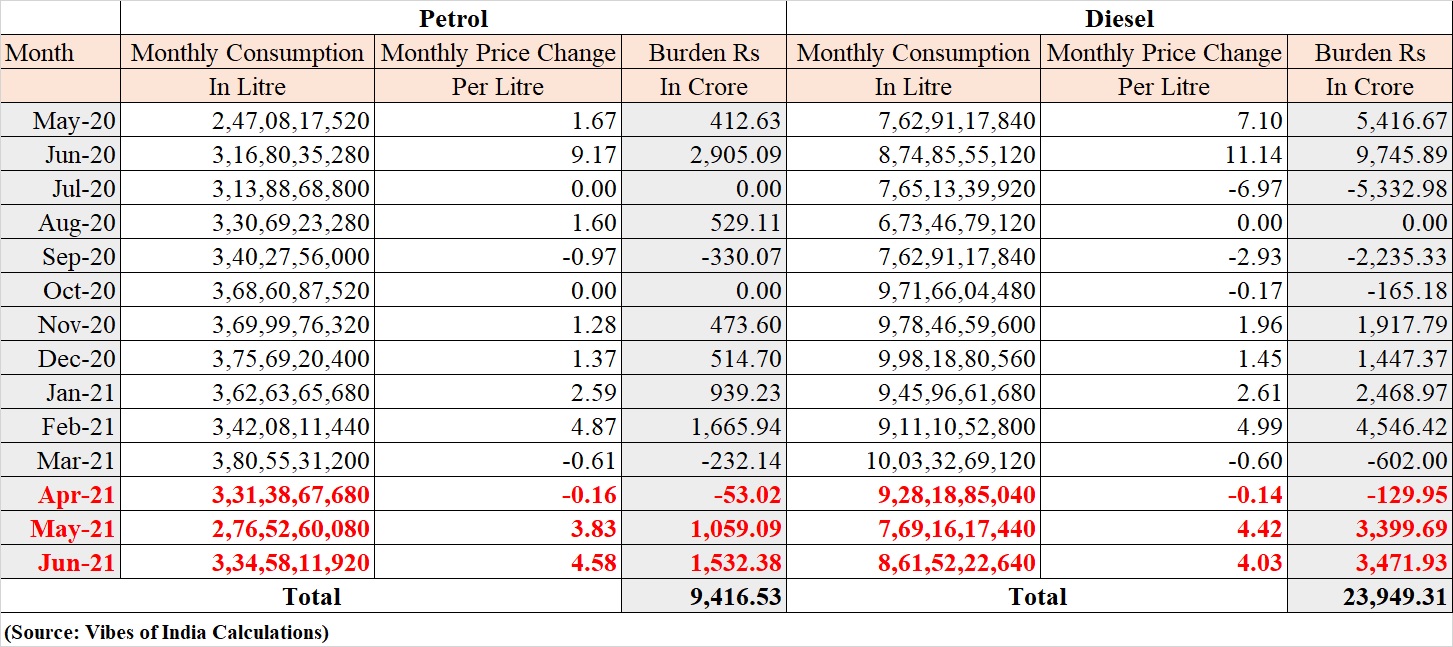

The total burden due to frequent hikes in prices since May 2020, has been Rs33,364 crore on the general public. The burden is calculated based on all India monthly consumption benchmarked against prevailing prices in Delhi. The burden due to hikes in prices of petrol stands at Rs9,416.53 crore while that for key transportation fuel diesel stands at Rs23,949.31 crore. The burden is over and above higher taxes collected by the central and state governments.

The government of India has collected Rs3,34,894 crore as central excise on petrol and diesel, a written reply from the ministry of petroleum and natural gas revealed in the Lok Sabha. Thus, the total burden due to taxes and the price rise comes to Rs3,68,258 crore – higher than the total budget expenditure on all 101 ministries or departments in the government of India, except Defence and Finance!

So the threat of inflation, the burden on people’s budget is all real. But the government is not budging. On its part government of India maintains that prices are dependent on market forces and as India imports most of its crude oil requirement, the local price behaviour is because of global price movement. However, this is not correct. The reason for the record high prices is not the global market but high taxes imposed by the government, to be precise the centre.

Ironically, all those critics of Dr Manmohan Singh’s government (2004 – 2014) are now silent. Whenever the prices were hiked, from film stars to BJP leaders or self-styled Yog Guru Ramdev to then chief minister of Gujarat Narendra Modi all never missed an opportunity to take a dig on Dr Singh’s government. However, all such leaders and actors are now silent. Most vocal voices for Modi – Anupam Kher, Akshay Kumar, Smriti Irani and Amitabh Bachchan are silent when prices are above Rs100 a litre in most parts of the country.

Why High Prices?

Since the presentation of budget 2015-16, by then finance minister Arun Jaitley, the duties on both fuels have been converted into specific rates and not ad valorem. In simple words, ad valorem means the amount of tax collected will rise with an increase in value of the product (and vice versa) while in specific rate, irrespective of the price the tax collection will remain stable – neither increase nor decrease. Hence, the root cause of the problem of record-high fuel prices lies in the budget of 2015-16.

| 2014-15 | 1015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 | |

| Excise Rs Crore | 99,068 | 1,78,477 | 2,42,691 | 2,29,716 | 2,85,301 | 1,97,845 | 3,44,746 |

| % Change | 80.16 | 35.98 | -5.35 | 24.20 | -30.65 | 74.25 | |

| Consumption 000 T | 1,12,748 | 1,23,260 | 1,25,876 | 1,32,138 | 1,38,301 | 1,37,869 | 1,21,273 |

| % Change | 9.32 | 2.12 | 4.97 | 4.66 | -0.31 | -12.04 | |

| Crude Oil Indian Basket | 84.16 | 46.17 | 47.56 | 56.43 | 69.88 | 60.47 | 44.82 |

| % Change | -45.14 | 3.01 | 18.65 | 23.83 | -13.47 | -25.88 |

(Source: Petroleum Planning and Analysis Cell)

The above table reflects that petroleum products consumption in India has grown in single digits between 2014 and 2021. Similarly, average crude oil prices (denoted as a dollar per barrel of Indian basket) was highest in 2014-15 and since then it has not crossed above $70 a barrel. Moreover, the prevailing price of fuel is highest in the country at the moment, and not in 2014-15 when the crude oil prices of the Indian basket were the highest.

In seven years, total excise collected by the government has increased by 248 percent or more than two and half times. All these years petroleum consumption in India increased just by 7.5 percent and crude prices fell by 47 per cent. So why are we paying higher prices when demand is flat and the international prices have fallen? The answer is simple, higher taxes imposed by the government is responsible for the burden on the people.

Taxes: Too High, Too Frequent

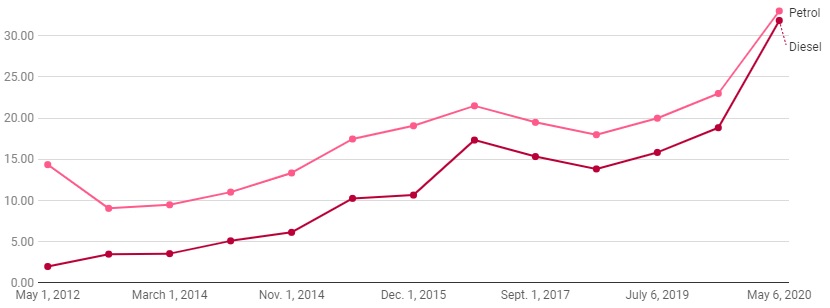

Since May 2012, the government of India has changed taxes on petrol and diesel 13 times. Of that, petrol taxes were increased 10 times while that for diesel increased 11 times. The highest number of tax changes have been bought by the present regime since May 2014. The highest ever excise increase came at midnight of May 5 2020, the government hiked excise duty by Rs10 per litre of petrol and Rs13 per litre on diesel.

In October 2017, the tax on petrol was Rs19.48 and on diesel, it was Rs15.33 per litre. After increasing it various times, it stands 68.9 per cent higher for petrol at Rs32.90 and 107.4 per cent higher at Rs31.80 for diesel, ministry of petroleum and natural gas data shows.

So over one-third of the prevailing retail price for each fuel consists of central taxes. Including state-level taxes, which are not uniform in the country, of the total burden more than half of the retail price is just taxes. State taxes are 20.1 per cent in Gujarat to 36 per cent in Madhya Pradesh, among major states. Any attempt to blame the international price of petrol is just an eyewash.

How Big is the Burden?

Frequent changes in the price of petrol and diesel, albeit in small quantities has dug a hole in common man’s purses. The Vibes of India has calculated the burden on price rise since May 2020 – when the country was under strict lockdown, international crude oil prices were low. However, without passing on the benefit of lower prices during a crisis, the government announced the steepest hike in history.

In 423 days from May 5 2020 to June 30 2021, the prices of petrol have gone up for 115 days – every third day a new price. For diesel prices were increased 109 times. There were only 11 days when petrol prices decline while the reduction was recorded in diesel for only 26 days. On a net basis, petrol prices increased by Rs29.22 per litre while that of diesel increased by Rs26.89.

Taking into account monthly consumption – data for which is available only till June 2021 – our calculations show burden due to increase in petrol price is Rs9,416.53 crore while that for key transportation fuel diesel stands at Rs23,949.31 crore.

Ironically for the people, the biggest burden of price rise has been witnessed in the first and second waves of the pandemic or when the Covid19 cases were the highest. In May and June of 2020, the total burden due to the increase in prices of fuels was Rs18,480 crore. During the second wave (Apil to June 2021), the burden was Rs9,280 crore.

Keep in mind irrespective of the price, as government charges specific duties, tax collection would remain constant. It goes up only with the quantity sold and not with the price charged (or vice versa). Taking into account tax collection of Rs3,34,894 crore in 2020-21, the total burden comes to Rs3,68,258 crore.

How big is the burden on Gujarat?

As per Vibes of India’s calculations, the total burden on consumers of Gujarat is Rs3,823.09 core – higher than the state’s budgeted revenue expenditure on rural development or labour or industry and mines department.

We calculated the daily increase in prices of petrol and diesel and how much burden it has put on the common man of Gujarat. As per our calculations, the total burden from 1 July 2020 to 21 June 2021 comes to Rs3,823.09 crore. The burden due to the rise in petrol prices is Rs1,337.24 crore and Rs2,485.85 crore for diesel.

The Impact

Transport operators are at receiving end. On one hand, reduced economic activities have reduced the volumes and on the other hand, the fuel price hike is a cause of concern. “There is an average increase of 10-12 per cent in freight charges. However, business volumes are down. I am operating a fleet of 22 tucks but not all in are used. I have shifted eight of my trucks to my farmhouse as there is no business volume and keeping them on the roads is unviable,” Hasu Bhagdev, president of Rajkot Goods Truck Transport Association says.

With an almost daily change in price, negotiations with customers are becoming complex. “If I run a trip from Rajkot to Mumbai, it will take six days for a truck to return. My trip may become less profitable if prices are changed en route. How do I business? I have stopped yearly contracts with my clients,” Bhagdev adds.

Lockdown last year and second wave now, has also reduced volumes. As most truck operators are owners and drivers, demand and supply are also at play. “In our industry 70 – 80 per cent of truck operators are owners as well as drivers. On the other hand, total transportation good volume is 70 per cent compared to a normal year. There are more trucks available to consignees compared to transport load. Hence, the increase in freight charges is not as high as diesel prices,” Mukesh Dave, president of Akhil Gujarat Truck Transport Association says.

Dave adds that cost recovery at this point is not possible for every individual. “Diesel prices is just one of the cost escalations. On average, toll tax now contributes 19 per cent of our costs compared to 5 per cent a couple of years back. Taking a short-term view, certain single truck operators are ready to ply even without viability or higher freight,” he said.