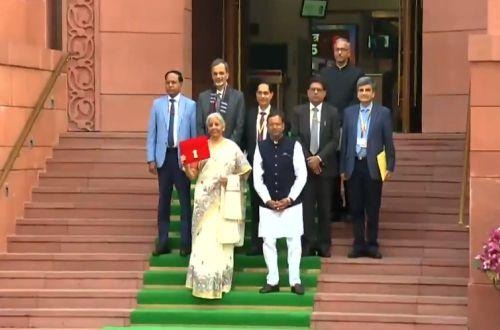

Finance Minister Nirmala Sitharaman on Saturday arrived at Parliament with a digital tablet wrapped in a traditional ‘bahi-khata’ style pouch to present the full Budget 2025-26 in a paperless format. Continuing the practice adopted in 2019, she posed for the customary ‘briefcase’ picture outside her office, accompanied by her team of officials, before heading to Rashtrapati Bhavan to meet President Droupadi Murmu.

Draped in a white silk saree, Sitharaman carried the tablet inside a red cover embossed with a golden-coloured national emblem. She then proceeded to Lok Sabha to present the Budget.

Sitharaman, India’s first full-time woman Finance Minister, had replaced the colonial-era briefcase with a ‘bahi-khata’ in 2019 and transitioned to a digital tablet in 2021 during the pandemic.

As she began her budgetary speech, some opposition MPs, primarily from the Samajwadi Party, walked out of Lok Sabha in protest. Samajwadi Party chief and former Uttar Pradesh Chief Minister Akhilesh Yadav led the demonstration, demanding a discussion on the Maha Kumbh stampede, which resulted in the deaths of 30 devotees.

The Budget, Sitharaman’s eighth consecutive one, is expected to address economic concerns amid high prices and stagnant wage growth. Analysts anticipate measures to boost consumption while maintaining fiscal prudence.

A cut or modification in income tax rates for the lower middle class is widely expected following Prime Minister Narendra Modi’s remarks invoking the goddess of wealth for the well-being of the poor and middle class.

“I pray to Goddess Lakshmi that the poor and the middle-class sections in the country are blessed by her,” Modi said on Friday before the budget session.

The government’s first full-year budget in its third term comes amid geopolitical uncertainties and an economic growth rate at a four-year low. Experts expect tax rationalisation, increased export incentives, expansion in production-linked incentives, and enhanced welfare scheme allocations. Further infrastructure investment and job creation measures are also anticipated.

Tariff reductions to promote local manufacturing, increased agriculture investments, and incentives to stimulate private consumption are expected to be key components of the Budget. The government is likely to adhere to its fiscal consolidation roadmap, targeting a fiscal deficit of 4.5 per cent of GDP for FY26, down from 4.8 per cent in the current fiscal ending March 31.

Also Read: PM Slams Sonia Gandhi’s ‘Poor Thing’ Remark As Insult To President