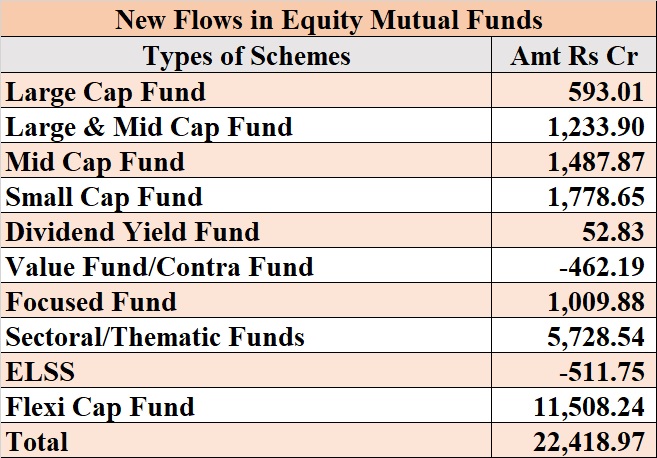

Buoyed by the investors’ interest in new fund offers, the total inflow in the equity mutual fund schemes jumped three-fold in July. As per the Association of Mutual Funds of India (AMFI), monthly data release new flow in equity scheme increase from Rs5,988 crore in June to Rs22.583 crore.

However, four new funds from major asset management companies contributed most of the new flows. Four new fund offers of equity schemes put together clocked inflows of Rs13,709 crore, AMFI data showed.

Meanwhile, new investors registered with the Bombay Stock Exchange for trading increased by 34.52 lakh to 7.62 crore as of August 7. Between April and July 2021, a total of 12 initial public issues have raised Rs27,036 crore from the market by way of fresh capital.

All schemes investing in large, small, medium and multi-cap funds recorded net inflows for July. The highest inflows, however, was recorded in funds that are investing in thematic or flexicap schemes.

Like primary and secondary markets witnessing record highs, systematic investment plans (SIP) also continued to be the biggest attraction for passive investors. Total SIP at the end of July stood at 4.17 crore compared to 4.02 crore in June. SIP has been a preferred means of investing in mutual funds, especially in equity funds. The contribution from SIP stood at Rs 9,609 crore in July compared to Rs 9,156 crore in the previous month. This has been the highest SIP contribution so far in mutual funds.