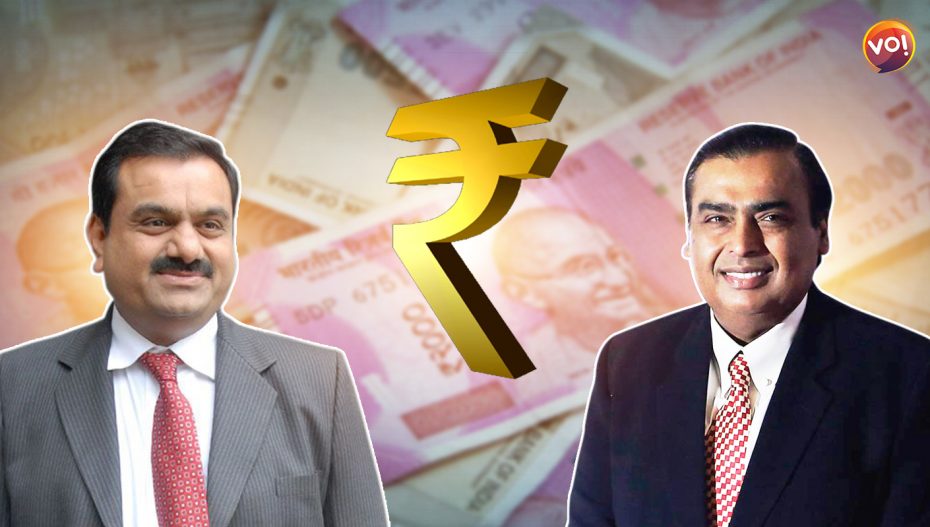

The top three business houses are expected to compete for a deal with Germany’s Metro AG to invest in its India unit Metro Cash & Carry. According to industry sources, Reliance, Adani Group, and Thailand’s conglomerate Charoen Pokphand (CP) are potential front-runners for a partial or full stake in Gurugram-based Metro Cash & Carry, which has 31 stores and 5,000 direct employees.

Approximately 20 companies, both strategic and private were approached by the Metro AG. The target company is estimated to be worth more than $1 billion.

Adani perspective :

A partnership with Metro AG would provide Adani with a new front against competitors. The Adani Group’s retail presence is mostly through the Fortune Mart, which just opened to market Adani Wilmar products. It has big plans for growth, going beyond its own oil and food businesses. plans The CP Group, based in Bangkok, operates through a subsidiary.

Reliance perspective:

If Reliance wins the Metro AG bid, it will strengthen its position in the retail space, allowing it to compete with majors such as Walmart, D-Mart, and Amazon.

Siam Makro perspective:

In several countries, Thailand’s Siam Makro is a big cash and carry player. Siam Makro announced in 2018 that it would enter the Indian wholesale cash and carry market under the e-brand Wholesale Solutions. A successful attempt to buy Metro Cash & Carry would help CP Group’s India objectives, according to another source.