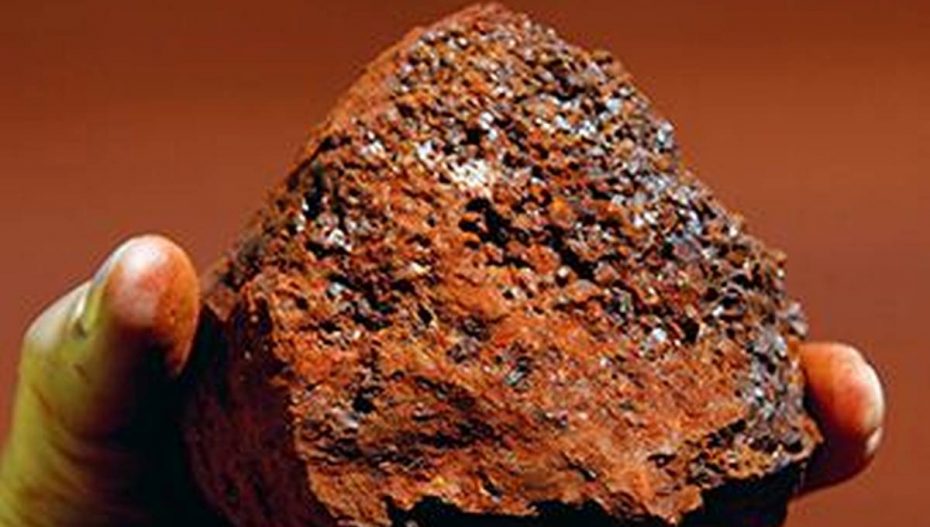

China’s imports have dropped following its move to control steel production to meet carbon emission norms due to which Iron prices have dropped to a near three-month low.

However, this global drop in iron prices has benefited Indian steel firms, with the National Mineral Development Corporation, the country’s largest iron ore producer, reducing lump ore prices by Rs 300 a ton and that of fines by Rs 200 to Rs 7,150 and Rs 6,160 respectively.

This is the second time that the NMDC has cut iron ore prices since July.

A significant reason for iron prices to decline is fears of the Chinese government controlling steel production in the next few months. Reports say that Beijing has asked 20 steel mills in Tangshan city to suspend operations at some of their units for a week ending Tuesday. The order was to help meet the norms for reducing carbon emissions. The Chinese steel sector makes up 15 percent of the total carbon emissions by the Communist country.

One of the world’s top five producers Shagang Group, located in Jiangsu province, has said that it was cutting its steel output to comply with its government’s efforts to cut carbon emissions. It has been asked to reduce its overseas sale of steel products by 50 percent.