It seems that the aftermath of the Covid19 pandemic on Indian households is still unfolding. Slump in economic activity, restrictions on working conditions and increasing layoffs and unemployment has devasted family income resulting in large scale selling of families’ physical gold holdings.

Indians, mostly middle class have reportedly sold 111 tonnes of their physical gold in the market between April 2020 and June 2021. Vibes of India has got these figures from the latest data of the World Gold Council (WGC) released last evening.

While the demand for gold has remained subdued in the country, selling personal gold holdings has gained momentum. In the June quarter, the selling of gold was 43% higher than the previous year and 32.8% higher than the quarter of March 2021. Of course, subsequently buying of gold has gone down by nearly 46 per cent in India.

“Due to Covid19 situation, lockdowns and slump in economic activity, many individuals are selling their physical gold to raise money. In certain cases, companies engaged in the business of lending against the gold have also forced to liquidated some gold as borrowers were not able to repay,” a gold analyst with a bullion trader said.

Even the WGC notes that the impact on rural income could be the reason behind higher selling activity. “The ferocity and spread of the second wave of Covid19 throughout rural India impacted income levels during the quarter. Many rural consumers turned to gold to meet medical expenses during the pandemic, forcing distress selling of gold,” the WGC said.

Meanwhile, Manappuram Finance Limited, a leading company that lends against the physical gold revealed the signs of strains on the repayment. “Manappuam auctioned gold collateral of defaulting customers worth Rs404 crore (or 1 tonne) in the quarter ending March,” the company presentation revealed.

“Cash flows of customers – rural and semi-urban is affected. Most of our customers are small farmers, self-employed, small-time entrepreneurs or daily wage earners. As the cash on their side is not comfortable they will not be able to repay the loan hence, we had to auction,” V P Nandakumar, managing director and CEO of Manappuam Finance had said in May, after the March quarter results.

Prices Fall, Selling Rises

Under normal circumstances, when prices of gold remain at elevated levels, recycling (selling old gold to replace it with new ones) activities are seen. However, despite lower prices, recycling has increase indicating a strain in finances at the consumer level.

“While strong economic growth may mitigate the need for distress selling and a more modest gold price appreciation makes recycling less attractive. However, should the pandemic worsen, we could risk seeing higher loan defaults in certain markets, most notably India,” the WGC notes in its report.

“The second wave of the pandemic, combined with the fact that the gold price at the end of March quarter was 17% below the all-time high last year, also impaired the ability of gold loan borrowers to meet repayments, with some reports emerging of higher gold loan defaults,” the WGC said.

Gold Demand down by 46%

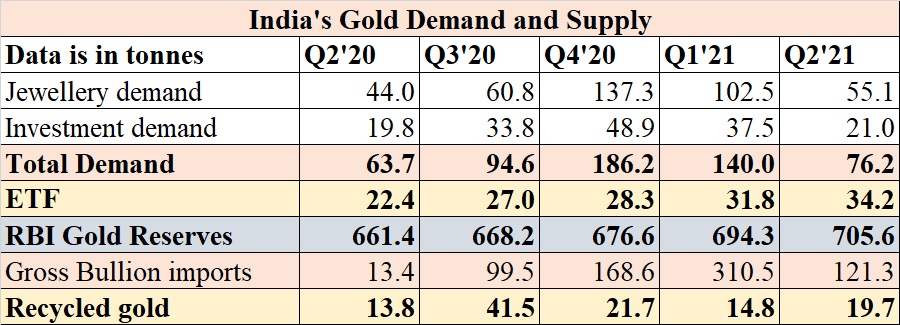

The total demand for gold in India (including jewellery, consumer and investment) stood at 76 tonnes in the June quarter, 20% higher than the previous year. However, the demand fell by 45.6% from the March quarter. This is the lowest demand for India in the last four quarters.

Jewellery demand for gold in India for the June quarter remained at 55.1 tonnes, 25% more than the previous year but 46% lower than the March quarter of the calendar year 2021.

“The demand remained subdued due to local restriction and a dull wedding season during April to June. The business was down, orders were down and buying was very limited,” Shantibhai Patel, president of Gem and Jewellery Trade Council of India said. However, he is optimistic about the demand outlook in the upcoming festive season.

“The monsoon seems to be normal. Markets are opening up and Covid cases are down. We are expecting buyers to be back in the next festive season,” Patel added.

As per WGC data, the Reserve Bank of India (RBI) continued to buy gold as part of its reserves. At the end of June 2021, RBI held 705.6 tonnes of gold in its reserves, which is 44.15 tonnes higher than June 2020.

As gold prices are higher it is not possible to buy gold for every individual as India is a low-income country. However, buying in ETF continued to remain strong. Total ETF holdings by Indian funds stood at 34.2 tonnes at the end of June 2021. This is higher by 11.83 tonnes from a year-ago period.

On the supply side, India’s gold imports slumped by 60% to 121.3 tonnes in the June quarter. The total imports stood at 310.5 tonnes in March quarter.

“Lack of buying due to higher prices, local restrictions across the country due to the second-wave had kept buyers away from the market. Despite offering the gold at discount (from the international market in wholesale), the jewellery making activity was very low resulting in lower imports,” a leading importer of the gold from Mumbai said.

Hallmarking an issue

Meanwhile, another hurdle on the trade has also dampened the sentiments in the market. “Hallmarking is a big issue. We need to get our old stocks hallmarked. It is a time-consuming process and that is the reason new making has reduced,” Mitesh Soni, a Rajkot-based gold jewellery maker said.

As per the government decision, all jewellery in India should be hallmarked from September 1. Pieces of jewellery that are not hallmarked will not be allowed to be sold in the market. However, the All India Jewelers & Goldsmith Federation (AIJGF) has urged Piyush Goyal, minister of commerce and consumer affairs to extend the deadline by one year.

“There are about 4 lakh jewellers in the Country out of which about 85% are small jewellers who cater to the needs of the common man for their requirements of jewellery from villages to metro-cities and therefore, the policies must be crafted to keep interests of such large number of our members,” Panakj Arora, president of AIJGF said.

Good article