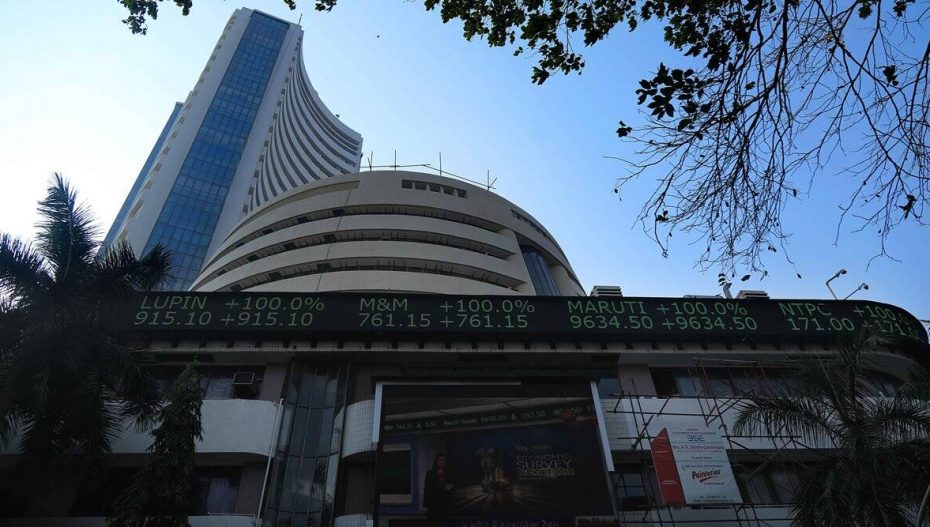

Indian shares are likely to open weak on global cues. The stock markets in Asia are trading weak on the rising value of the dollar against the major currency and a sharp fall in gold prices that triggered margin calls.

The Nifty futures closed at 16,267 on Friday while the SGX Nifty Futures (the index that trades in Singapore) is trading at 16,246 indicating a weak opening in India by 21 points. The major trigger that needs to be looked at is the trading activity by domestic funds. The funds have been major support against continued FPI selling so far. However, domestic funds turned net sellers on Friday to the tune of Rs631 crore.

A rise in the dollar would also be a cause of worry for India. It increases the value of imports for India. However, information technology stocks may gain as their earnings are mostly export-dependent. Bank of Baroda, Divis Lab would also be under the radar after their results.