Rocked by recent allegations of accounting wrongdoings, operating shell companies in tax havens, inflating share values by giving a misleading picture of revenues, and round-tripping funds, the Adani Group was linked to case studies of corporate misgovernance. While the group vehemently contested the Hindenburg report, which detailed the charges, it emphasised commitment to openness and transparency.

Now, as a strong step towards damage control and winning stakeholders’ trust, Adani Ports and Special Economic Zone, one of its group companies, said it allocated $130 million of its debt for early payment. Almost $413 million worth of debt had earlier been tendered for early payment, according to a report.

We may recall that Adani Ports floated a tender of up to $130 million of 3.375% 2024 maturity dollar-denominated bonds last month as a reputation-salvaging measure.

The charges came at a time when the group flagship was planning to capture the equity market after 29 years.

As the sage unfolded, the group’s seven-listed stocks lost close to $114 billion in market value, claimed media reports.

The control the negative narrative, the group sent a 400-page-plus rebuttal to market regulator SEBI, besides media releases.

Additionally, to foster trust in investors, the group showcased seriousness towards sustainability-related activities. The business announced a slew of programmes to promote renewable energy and minimise the carbon impact of its operations on the environment.

Also Read: Karnataka Elections: 5.3-Cr People To Vote Tomorrow

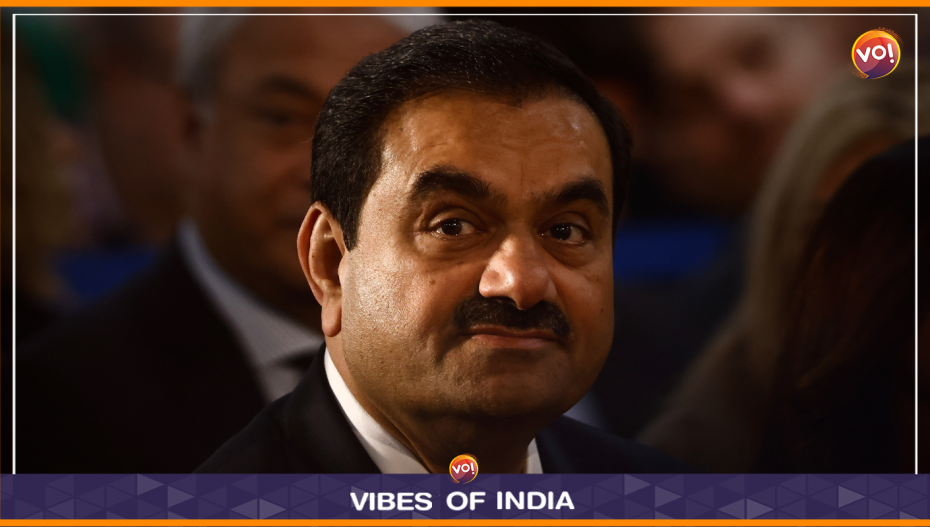

(Photo credit: Bloomberg)