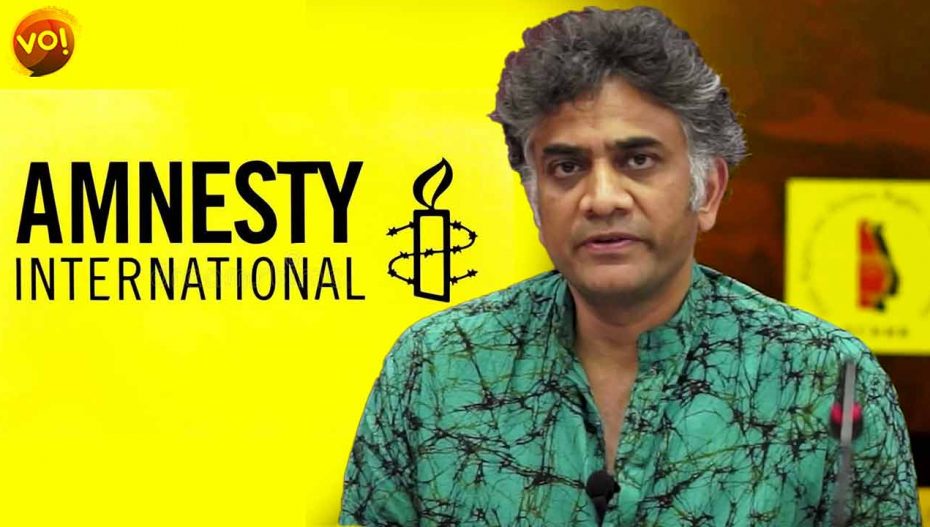

Taking an aggressive position, the Enforcement Directorate on Friday issued a show-cause notice to Amnesty International India and its former chief executive officer (CEO) Aakar Patel over charges of violation of the Foreign Exchange Management Act (FEMA). The agency slapped a penalty of ₹51.72 crore on the human rights body while Patel has been fined ₹10 crore.

The Enforcement Directorate had initiated a probe under the FEMA based on allegations that Amnesty International UK had been remitting massive foreign contributions through its Indian entities through Foreign Direct Investment (FDI) to evade the Foreign Contribution Regulation Act (FCRA).

These funds were allegedly received to expand NGO activities in India despite the denial of prior registrations or permission to the organisation and Amnesty India Foundation Trust and other trusts under FCRA by the union home ministry, a statement by the ED said.

According to the show-cause notice, between November 2013 and June 2018, remittance received by Amnesty International India and claimed as a receipt for business consultancy and PR services is nothing but borrowed from the overseas contributor, thereby in a clear violation of FEMA.

The probe agency said on following the principal justice after receiving a detailed reply from Amnesty International India, the adjudicating authority of the probe agency held that AIIPL is involved in activities that are not relevant to their declared commercial businesses and the model has been applied by them to route foreign funds in the guise of business activities to escape the FCRA scrutiny.

“All contentions and submission from AIIPL regarding the claim of the remittance towards the export of services to Amnesty International have been dismissed, in the absence of concrete evidence,” the ED statement read.

The agency’s official statement added, “Consequently, it is held that the funds received by AIIPL through inward remittances to the tune of ₹51.72 crore are nothing but the fund lent by Amnesty International to AIIPL to ensure its objectives in the territorial jurisdiction of India, which is not accordance with the provisions of Regulation 3 of Foreign Exchange Management (Borrowing and Lending in Foreign Exchange) Regulations, 2000.”