In a shocking expose, it has been revealed that 84 lakh farmers of Gujarat purchased insurance of over Rs 53,000 crores in four years but only 24 lakh of them could claim some insurance. Out of the Rs 53,000 crore insurance money, only Rs 5000 crore were paid out as claims. Gujarat farmers have blamed the Pradhan Mantri Fasal Bima Yojana (PMFBY), a government-sponsored crop insurance scheme that integrates multiple stakeholders on a single platform.

Jairajsinh Parmar, a BJP spokesperson from Ahmedabad, said claims were wrongfully made as farmers’ selections were based on a survey. Farmers are only required to undergo an eligibility process for insurance and pay a nominal amount for validation. The Gujarat government will cover the insurance premium. Additionally, farmers facing challenges can contact relevant authorities to have their issues resolved.

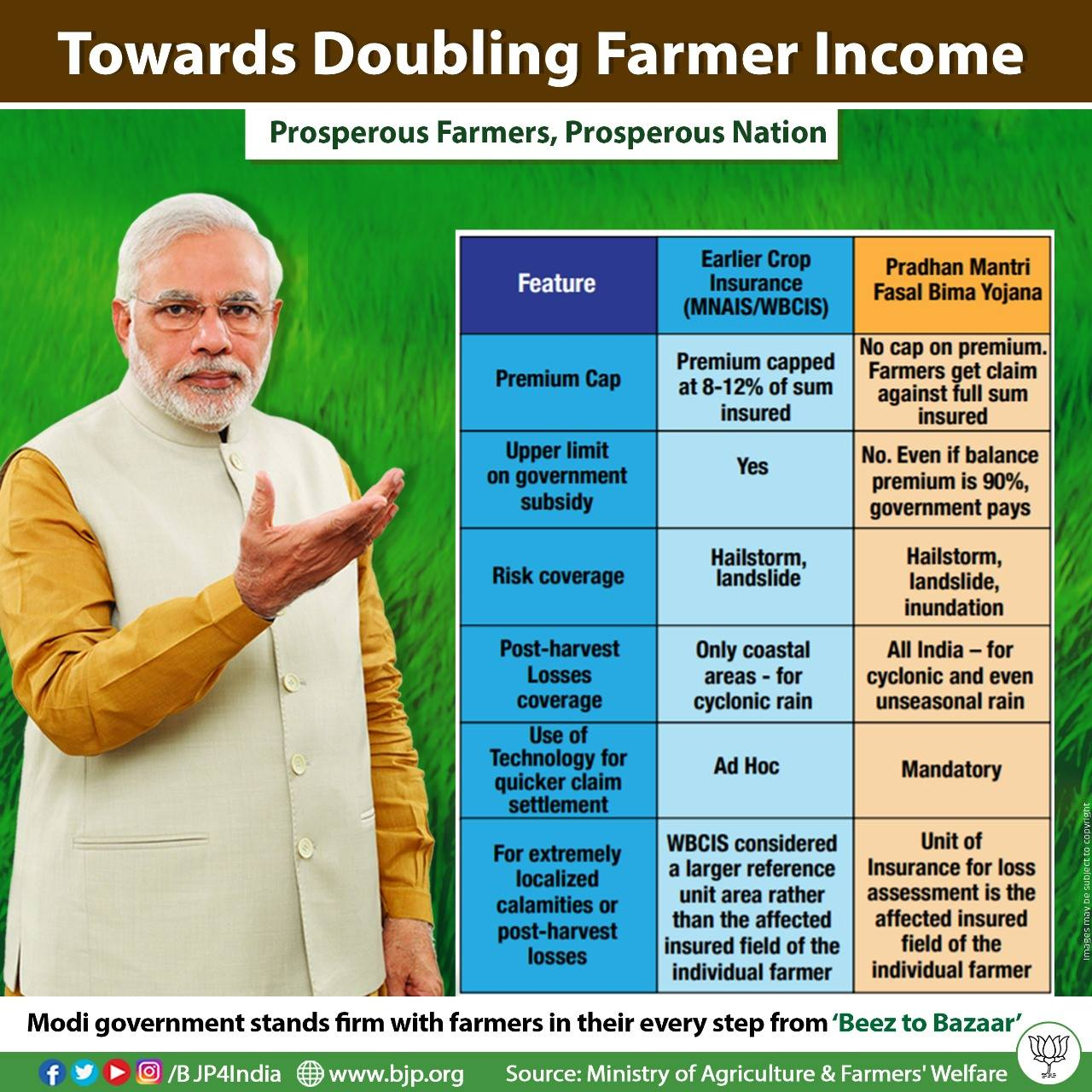

Speaking to the Vibes of India, Arjun Modhwadia, Congress MLA from Porbandar, highlighted that the scheme was initially started by the Rajiv Gandhi government, where damage amounts based on crop assessment were provided by the central and state governments in a 50-50 ratio. However, when Prime Minister Narendra Modi launched a similar scheme in 2015, the insurance amount was expected to be covered by companies. In the past three years, farmers have felt helpless. He urged the government to adopt the original strategies and policies that would benefit farmers rather than insurance companies.

The scheme, which began in 2016, was terminated by the Gujarat government in 2020. Farmers allege that while insurance companies collected the premium amounts, they are now withholding insurance payouts. Between 2016 and 2020, a total of 83.95 lakh individuals insured their 11.23 lakh hectares of land. The total sum insured amounted to 53,812 crores, with a premium contribution of 12,045.26 crores from the government and farmers combined. Farmers’ share of this premium was 1,499.41 crores, while the remaining amount was paid by the government.

When agricultural losses occurred due to rain and floods, only 24.94 lakh policyholders received compensation to the tune of 5,232.61 crores. Shockingly, 58.99 lakh applicants received no payment at all. Divya Bhaskar made efforts to address the issue by engaging in discussions with insurance companies to seek a resolution. Officials from the relevant government department were also consulted. According to these officials, the government has been actively attempting to resolve the situation through correspondence with insurance companies. Insurance companies often attribute delays to technical issues, a claim that the government has received multiple times. The government acknowledges that valid concerns exist from both farmers and companies, and its primary objective is to ensure fairness for all farmers involved.

More than 5,000 individuals from villages in Surendranagar taluka wrote to the collector, urging the payment of insurance claims. The sarpanch (village head) of Danawada village filed one such complaint, citing heavy rainfall and resultant agricultural losses. Despite the majority of farmers having insurance, only a few received compensation. RTI activist and farmer Bharat Singh Jhala criticised the government for making insurance mandatory, resulting in deductions from farmers’ accounts without proper documentation or information.

Regarding premium payments, the state government assigned the task to eight private insurance companies. However, some of these companies failed to fulfil their obligations, leading to the blacklisting of SBI General Insurance after numerous complaints from outraged farmers across the districts. SBI officials explained that the state and central governments were responsible for providing the remaining portion of the premium as a subsidy. However, owing to a lack of government funds, they were unable to meet the insurance payouts. The company further argued that it faced a shortage of personnel to process the claims.

Originally launched as a pilot project, the government intended to improve the scheme based on its performance. When an insurance claim is rejected, specific reasons are provided to the insured. To initiate a claim, farmers can communicate information about crop losses by visiting the insurance company’s office or contacting them by phone. In the case of major natural calamities, the government conducts assessments and informs the insurance company.

In cases where a significant number of claims are rejected, it is the insurance company that assesses and decides whether to accept or reject the claim. The policyholder should be notified of this decision, and if not, they have the right to file a complaint.

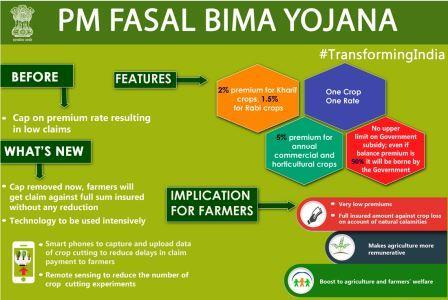

Where premium contributions are concerned, farmers pay 1-2% for grains and oilseeds, while for commercial crops, the farmer’s share can reach a maximum of 10%. The remaining portion is covered by the government, although some changes to these percentages may occur.

The premium can be deducted from a farmer’s account without explicit notification, especially for those who have taken loans. However, insurance documents should be provided to the insured as proof of coverage.

Regarding the assessment of crop damage caused by water, insurance companies conduct random sampling or use other assessment methods. If the assessment results in a rejection, the claim can be disputed.

The situation surrounding the Pradhan Mantri Fasal Bima Yojana in Gujarat remains a concern for farmers as they await resolution and fair compensation for their losses.

Also Read:28 People Fall Prey To Visa Scam; Crime Branch Arrests 3