As India ambles into 2022, it is already staring at what threatens to snowball into a third wave of Covid-19 with the new variant, Omicron, leaving the government, experts and people alike flummoxed.

The numbers are increasing at an alarming rate, but the cost of treatment remains unchanged or is rising while the Central Government has either left GST on medical supplies and all related essentials untouched or hiked it.

Hospitals and doctors across the country are already grappling with continuous streams of patients. Nearly 800 Omicron cases were reported as daily Covid-19 infections rose by 9,195 cases – a whopping 44% from Dec 28. The situation is worse in Delhi where the State Government has introduced Yellow Alert.

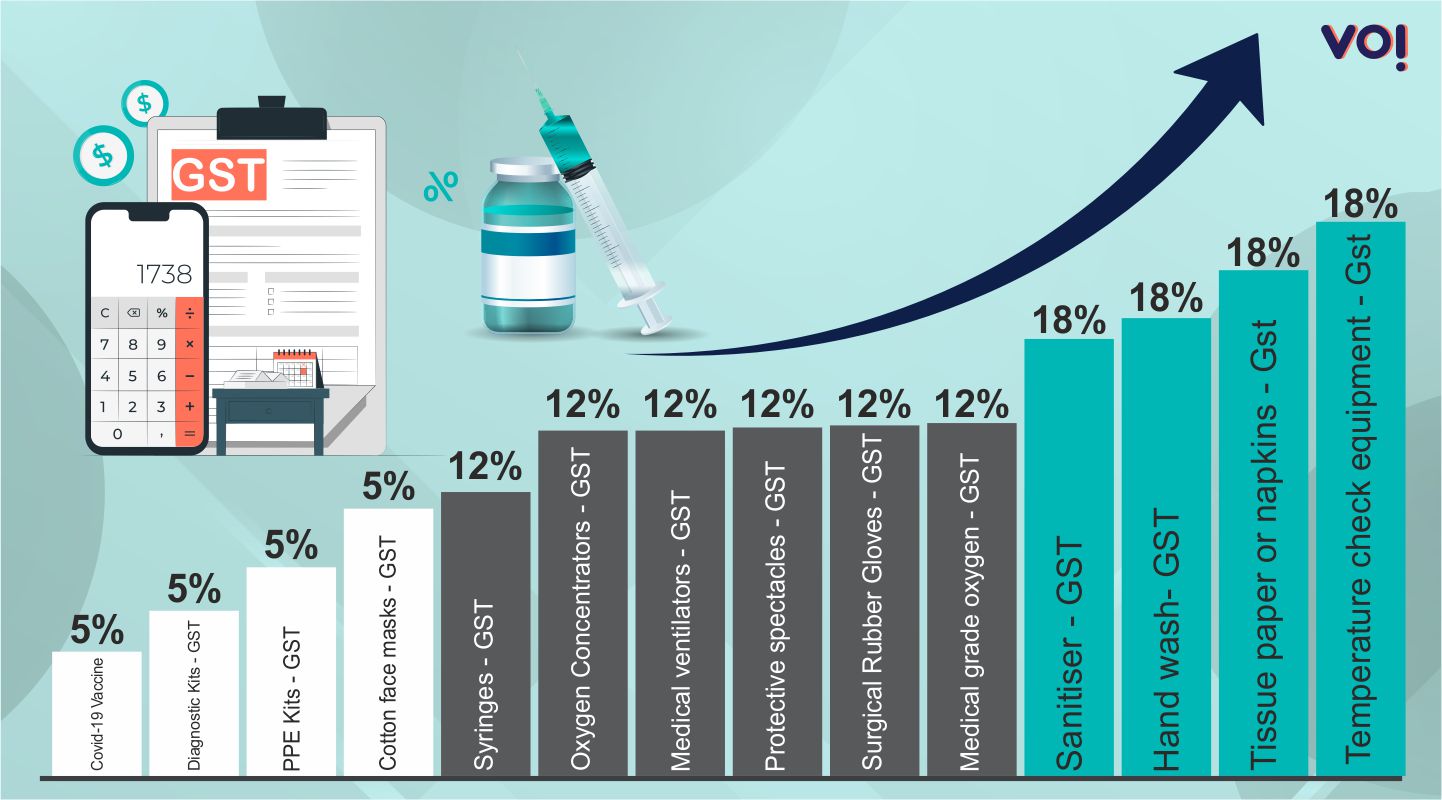

And guess what’s the GST (Goods and Services Tax) on medical grade oxygen, gloves, and ventilators? It is 12%.

For sanitizers, you have to pay 18% GST and 5% for the ubiquitous mask.

Former president of Ahmedabad Medical Association and Chairperson of women wing’s Indian Medical Association, Dr Mona Desai points out how a Rs 2 gloves are now available for Rs 20 or N95 masks that came for Rs 25 now costs Rs 800 each.

“The government asks doctors to do ‘seva’ but when it comes to taxes, the same government levies business level taxes on us. Due to GST, the prices of medical grade oxygen and oxygen concentrators have increased, making it extremely difficult for hospitals to buy these life saving equipment,” Dr Desai asserts.

“None questions the pharmaceutical companies who raise the bar so high that the end consumer finds it tough to afford help during Covid,” she adds.

N95 mask manufacturer Deepesh Agarwal, who has a unit in Pipal village, says, “The GST Council lacks empathy. It should recommend an exemption on such drugs and equipment to the Central Government, but they are not doing it.

He points out, “As a manufacturer, 5% GST on masks doesn’t bother us but as a consumer I definitely see the larger issue where people don’t even have something as life saving as masks. It is advisable to slash GST on this product.”

Section 11 of the Central Goods and Services Tax Act empowers the Central Government to exempt goods or services, or both, from the tax on the basis of the recommendations of the Goods and Services Tax Council, if it is satisfied that it is necessary in the public interest.

Trinamool Congress has been pushing the Central Government to slash GST. West Bengal Chief Minister Mamata Banerjee was the only CM to have alerted the Centre over the hefty taxes on Covid-related items. In June 2021, TMC MP Sukhendu Shekhar Roy had said, “The GST on ambulances has been decreased from a whopping 28 % to 12 %, is that a joke? The lack of sensitivity of the Central Government to even think of imposing GST on ambulances is ridiculous. In this situation, keeping the tax intact with the first line of defence against the deadly virus is an example of an anti-people government.”

Another Ahmedabad-based medical equipment manufacturer Chirag Kalra said, “A PPE kit manufacturer buys textile at 12% and sells PPE kit at 5% GST. As a manufacturer, our working capital is already blocked and therefore the GST on the product is not much of our concern. We get a refund. But again, the issue is of a commoner who is asked to pay a price even in the middle of a pandemic.”

Dr Bharat Gadhavi, president of Ahmedabad Hospitals & Nursing Homes Association, said, “The government charges high amounts of GST on medical equipment but hospitals get no benefit out of it. Hospitals do not get an input tax credit. In a crisis situation like this, the government should not levy or at least reduce the GST on daily usage products like sanitizers, masks, handwash, gloves etc.”

Dr Chandresh Jardosh, former president of the Gujarat branch of Indian Medical Association, echoes these views. “Vaccines alone can’t save people from Covid; what’s equally important are masks, hand wash, sanitizers and other medical equipment,” he says.

Dr Jardosh stresses that, “The government should subsidise these essential products and make sure to supply it to the common man. If one person gets infected by Covid, the eventual burden would increase on the government. Medical equipment should be sold like generic medicines. Secondly, the tax also increases the economic burden on the commoner –when people have lost jobs and are earning less than before.”

1. Medical grade oxygen – GST 12%

Medical grade oxygen used in oxygen cylinders is charged a GST of 12 per cent.

2. Surgical Rubber Gloves – GST 12%

The medical-surgical rubber gloves are charged a GST of 12 per cent.

3. Sanitiser – GST 18%

Hand sanitizers fall under the category of disinfectants and it is charged a GST of 18 per cent.

4. Cotton face masks – GST 5%

Woven fabrics of cotton masks attract GST at the rate of 5 per cent

5. Hand wash- GST 18%

Organic surface-active products and preparations for washing the skin, in the form of liquid or cream attract GST at the rate of 18 per cent.

6. Protective spectacles – GST 12%

Protective spectacles which are mostly used by healthcare workers to treat covid-19 patients are charged a GST of 12 per cent.

7. PPE Kits – GST 5%

PPE Kits made of Non-woven Textiles attract GST at the rate of 5 per cent and if sale value not exceeding Rs 1,000 per piece.

8. Diagnostic Kits – GST 5%

All diagnostic kits and reagents are charged a GST of 5 per cent.

9. Tissue paper or napkins – GST 18%

Cellulose handkerchiefs, cleansing tissues and napkins are charged a GST of 18 per cent. These items is mostly used for treating Covid-19 patients or for common household hygiene

10. Medical ventilators – GST 12%

Mechano-therapy appliances like Ventilators and other artificial respiration devices are charged a GST of 12 per cent.

11. Oxygen Concentrators – GST 12%

Integrated GST rate on oxygen concentrators for personal use to 12 per cent.

12. Temperature check equipment – 18% GST

Hydrometers and similar floating instruments like thermometers, pyrometers, barometers, hygrometers, psychrometers and any combination of these instruments are charged 18 per cent GST under 9025 HSN code.

13. Syringes – GST 12%

Instruments and appliances used in medical, surgical, dental or veterinary sciences, including scintigraphic apparatus, other electro-medical apparatus and sight-testing instruments are charged 12 per cent GST.

14. Covid-19 Vaccine – 5%

At present, 5 per cent GST is levied on domestic supplies and commercial imports of covid related vaccines.