Statewide raids on petrol pumps were carried out by the state GST department on Monday, in which it was found that sales of Rs 400 crore were made without VAT registration.

The petroleum company sells petrol-diesel to the petrol pump after which VAT is levied on it. For this, petrol pumps have to register. The input tax credit is then given for the purchase of taxable goods subject to the rules. The tax credit cannot be obtained if the petrol pump does not have VAT registration.

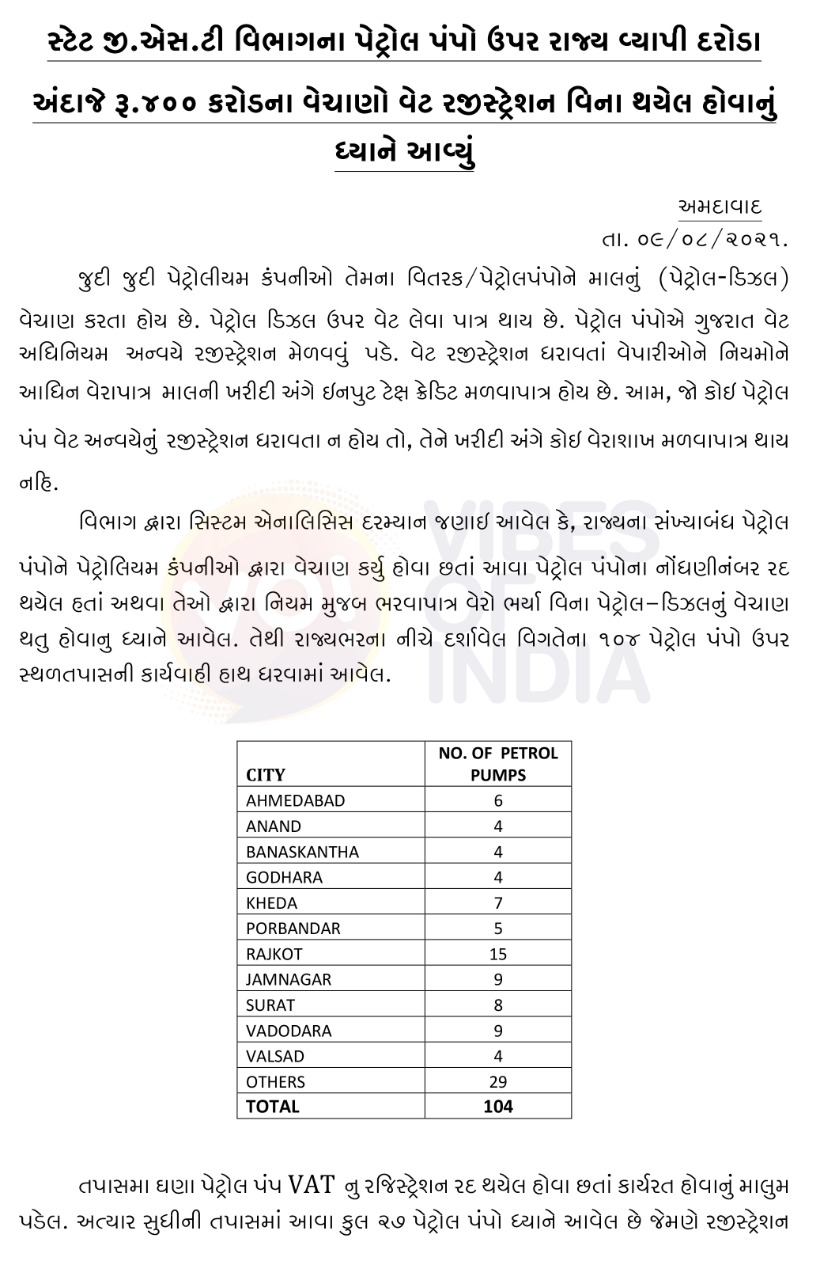

Many petrol pumps in Gujarat were either selling fuel after their registration numbers were cancelled or they were selling fuel without paying taxes. The GST department conducted spot checks at 104 petrol pumps.

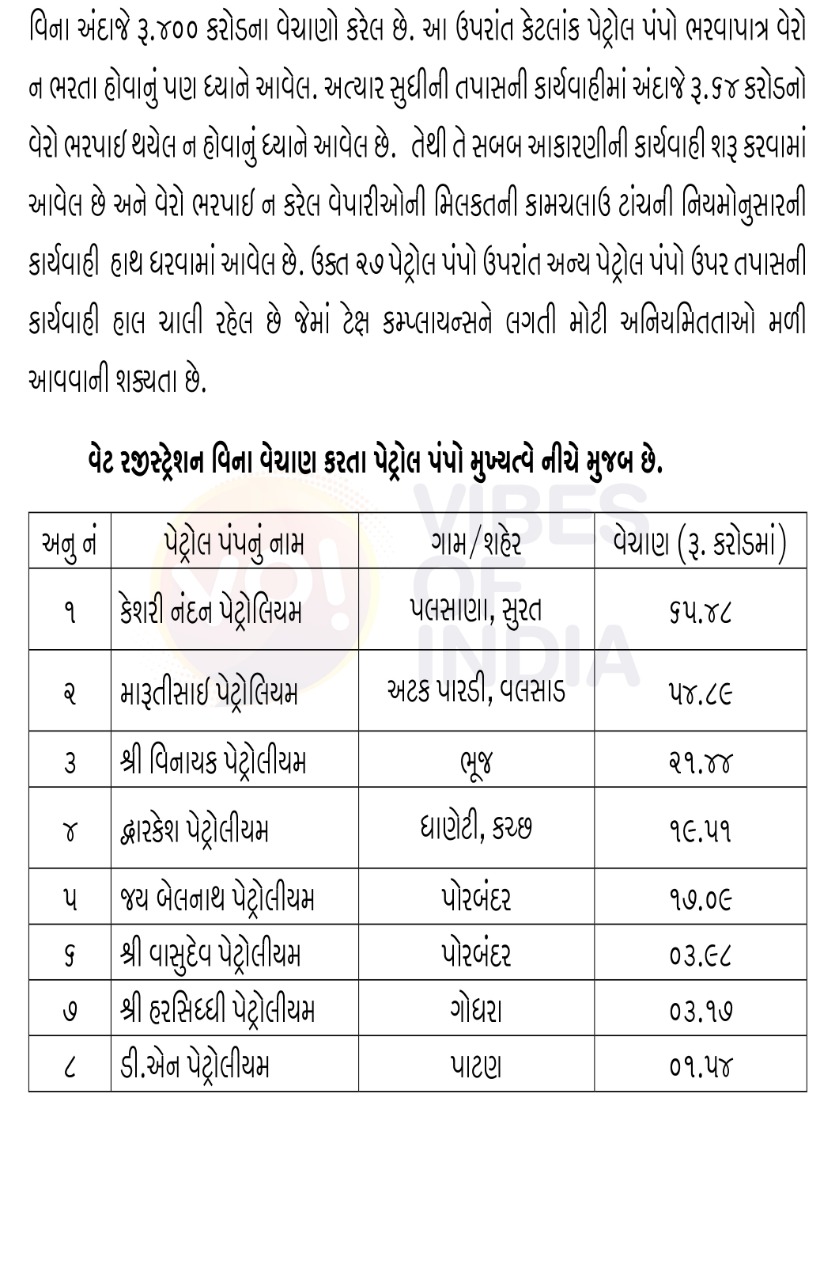

These included six petrol pumps in Ahmedabad, four each in Anand, Banaskantha, four in Godhra, seven in Kheda, 15 in Rajkot, nine in Jamnagar, eight in Surat, nine in Vadodara and 29 other petrol pumps. So far, 27 petrol pumps have been found where they were operating despite the cancellation of VAT registration. They have sold fuel worth Rs 400 crore of which tax is due for Rs 64 crore.