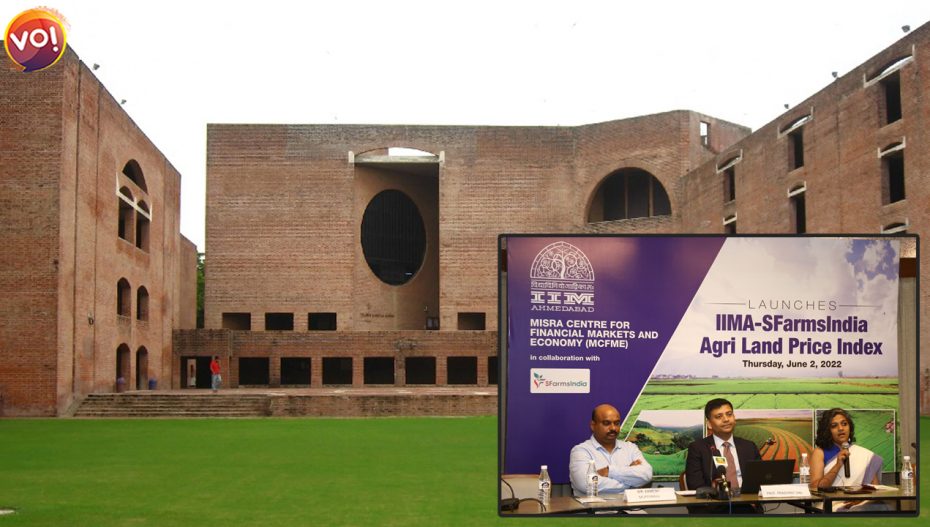

In collaboration with India’s first agri-land marketplace SFarmsIndia, IIMA, a premier global management institute, has launched the IIMA-SFarmsIndia Agri Land Price Index (ISALPI), a first-of-its-kind land price index that will record and present ‘quality controlled’ information of agricultural land prices across the country on Thursday, June 02, 2022.

The index is especially valuable for comparing land values in rural and semi-urban areas. In this situation, the index will serve as a trustworthy indicator of the an agricultural land’s potential to turn into a real estate area.

SFarmsIndia is a portal that links potential buyers and sellers of agricultural land in India. It is among India’s few platforms dedicated solely to agricultural land listings. The portal now has over 7000 land listings and over 25,000 registered buyers and sellers. SFarmsIndia has been successful in removing intermediaries, increasing price transparency, and broadening the range of opportunities available to rural vendors.

Speaking about the relevance of the index in the current scenario, Errol D’Souza, Director of IIM-A said: “With just over 200 million hectares, India houses just 2% of the world’s cropped land; but feeds over 15% of the world’s population. Recently, we have witnessed a surge in entrepreneurial interest in Agri land and allied professions: From agricultural engineering to precision farming, from food technology to supply chain management and green energy. We believe it is the right time to launch such an index for India.”

She explained the goal of the index, and said, “With ISALPI, we hope to build better data sources for all stakeholders. It is for their better decision making at national and regional levels to support the agribusiness activities.”

Currently, ISALPI is using land listing data from Andhra Pradesh, Karnataka, Maharashtra, Tamil Nadu, Telangana, and Uttar Pradesh. The index could become more beneficial in two ways when more data from other Indian states becomes available. It will, first and foremost, provide a better portrayal of the national context. Secondly, it will give a more granular index at the regional level.

Furthermore, legislators, local governments, environmentalists, investors, real estate developers, and financiers could profit significantly from this index. Local governments, for example, can use the index to compensate persons who lose land due to highway expansion.

Further, elaborating the index utility, project lead and associate professor of Real Estate Finance at IIMA, Prashant Das, said, “Investors could use this information to assess the historical risk and return in the past and predict these metrics for the future to decide on their investment positions. Fund managers and producers could use this information to broadly benchmark their performance. Financiers and insurers could use this information to assess the risk in the company related to the asset class reflected in the index. Researchers could use this information to study how economic events and factors are associated with price movements in a specific asset class. Policymakers (e.g. the Central bank) may use it to modulate their policies.”

Kamesh Mupparaju, the CEO of SFarmsIndia said, “SFarmsIndia has a strong focus on data warehousing and mining aimed at bringing cutting-edge agri-realty domain-specific AI capabilities to the market. The collaboration with IIMA to develop an Agri-land price index (ISAPI) is an important step in this regard.”

At IIMA, the Misra Center for Financial Markets and Economy is a Centre of Excellence, in researching the Indian Financial Markets and Economy. The Center will create a focus for research and teaching on financial markets based on an overall economic framework.

Read More: IDF World Dairy Summit To Organise Poster Competition In September 2022