Income Tax Department celebrates 161 years of the introduction of income tax in India. The Income Tax Department administers direct tax laws of the country, contributing to more than 52% of the total tax revenue of the government of India.

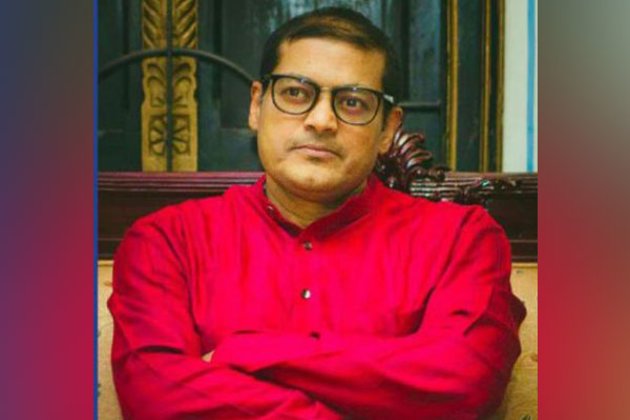

On this occasion, 1984 batch IRS officer Krishna Mohan Prasad, a member of the Central Board of Direct Taxes (CBDT) emphasised easing the problem of tax litigation on Saturday morning. “To minimize the pain of tax litigation. In the recent initiatives taken in 2019, the monetary limit for an appeal before the Income Tax Appellate Tribunal has been increased to Rs 50 lakh from Rs 20 lakh earlier. In the case of high courts, the limit has been doubled to Rs 1 crore and in the case of the Supreme Court, the revised limit for filing an appeal has been increased from Rs 1 crore to Rs two crore.”

India is a litigious society, even when Covid slowed down the economy filing of cases in courts didn’t stop. Litigation is a painful task and the government is looking to address taxation-related pain points and cut down the number of tax litigations while focusing on some of the major issues that may lead to revenue generation.

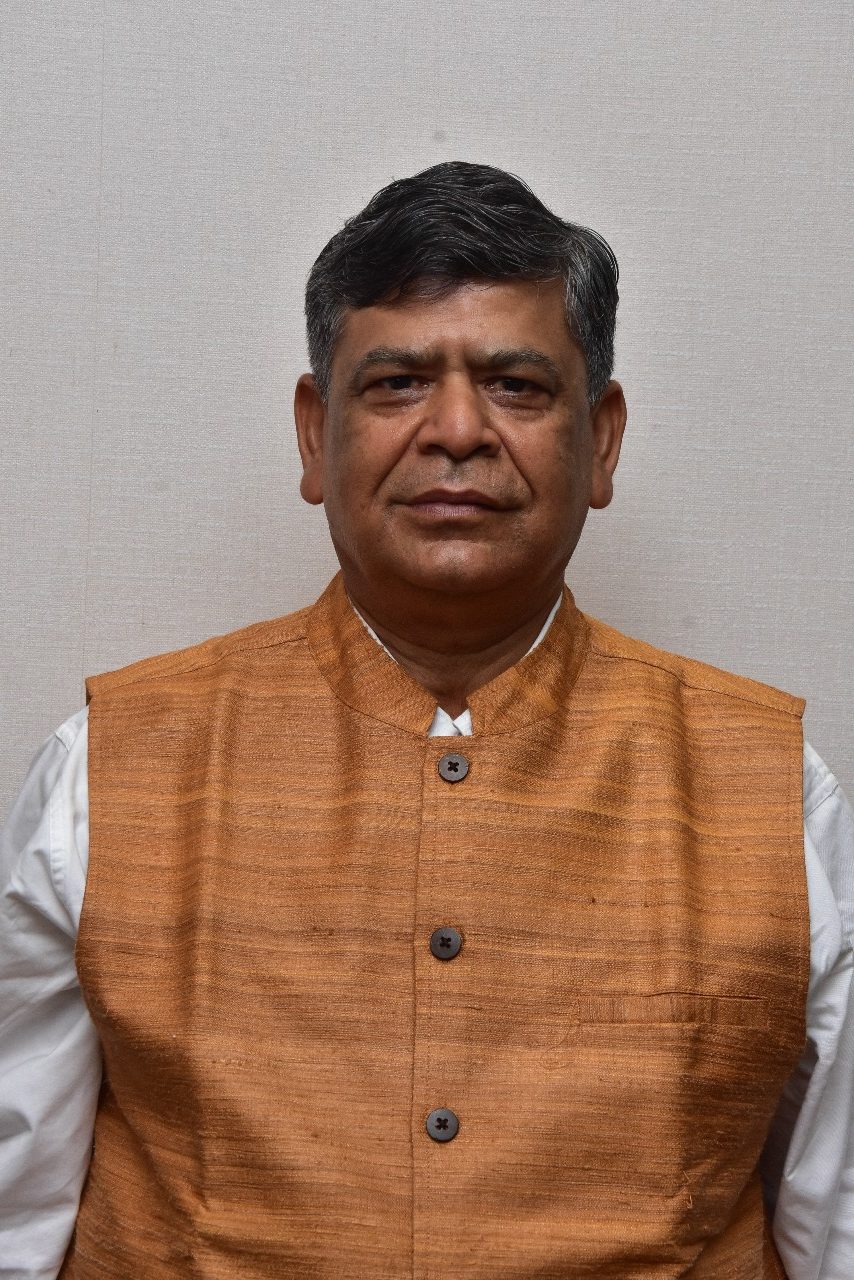

Ravindra Kumar, a 1986 batch IRS officer, principal chief commissioner of income tax (PrCCIT) said, “Chhoti ladai kyu lade? We want to focus on the big fish. We want people to not get into the legal hassle for a smaller amount, therefore we have set a bar for monetary limit in matters of tax dispute or evasion. It also allows us to address the larger issue.”

A massive amount of Rs six trillion is stuck in just direct tax litigation in courts and tribunals; first appeals have locked up Rs 5.6 trillion. In some cases, prosecution notices are issued when a taxpayer has not paid or delayed paying as little as 1,000.

Introduce tax education in the school curriculum

“Schools should include tax education as a part of their curriculum. This will lead to better tax literacy in the country and reduce tax evasion. To ensure a high level of expenditure on developmental activities like education, health care, infrastructure, employment etc it is necessary that people pay taxes and it will lead to the tax GDP ratio increase substantially, Prasad said.

It is desirable that a paradigm shift in the narratives about the tax payment is done. “The new narrative should highlight the payment of tax as more pious and charitable than the charity itself as taxes are used for promotion of education, health environment, relief to poor National security and national development,” Prasad concluded.

India’s tax GDP ratio is 10%, France’s 45%

Direct taxes are the mainstay of government revenue. There exists a strong correlation between the tax GDP ratio and the degree of economic development. To simplify, if you earn more, you pay more tax. Your economic development directly leads to higher tax collection for the government.

“The tax as a the proportion of GDP is higher in high-income countries than in India. For India, to achieve a high level of economic prosperity and high per capita, income tax as a percentage of GDP must be raised to at least 25% of GDP. The tax GDP ratio in India remains around 10% only, whereas in the developed countries like USA, UK France, it is above 30%. In fact, in France, it is above 45%.” Prasad added.