A statement released by Reliance Industries on Monday read, “Reliance New Energy Ltd., a wholly-owned subsidiary of Reliance Industries Ltd., said it had signed definitive agreements to acquire the assets of Lithium Werks BV for a total transaction value of $61 million, including funding for future growth substantially.”

Lithium Werks BV was founded in 2017 by acquiring Valence and A123 industrial division assets. It has operations in the US, Europe and China and customers worldwide.

The assets that Reliance will acquire include the entire patent portfolio of Lithium Werks, its manufacturing facility in China, key business contracts and the hiring of existing employees.

The management of Lithium Werks brings over 30 years of battery expertise and nearly 200 MWh annual production capacity, including coating, cell and custom module manufacturing capability.

Lithium Werks is a leading provider of cobalt-free and high-performance Lithium Iron Phosphate (LFP) batteries. With the resurgence in demand for LFP batteries and Lithium Werk’s integrated portfolio of LFP solutions, Reliance aims to take advantage of the global opportunities before it.

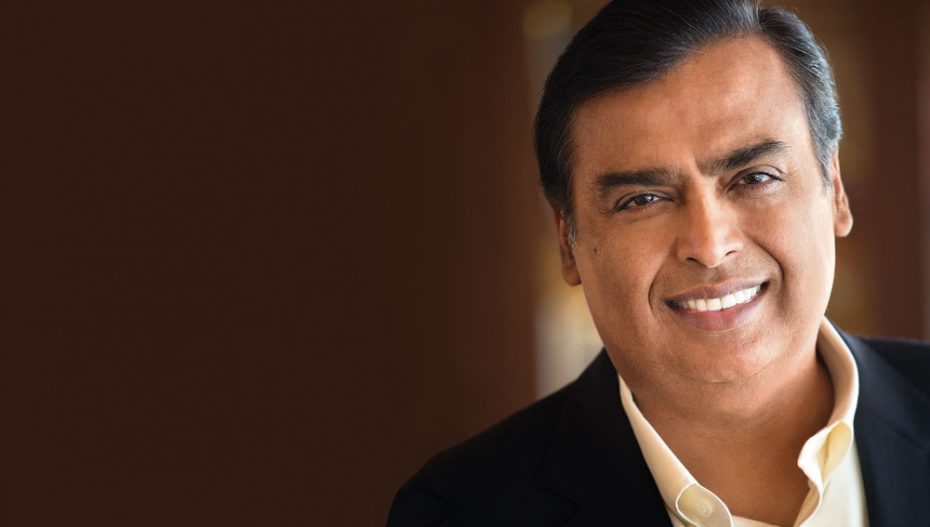

Mukesh Ambani, Chairman of Reliance Industries Ltd. said, “LFP is fast gaining as one of the leading cell chemistries due to its cobalt and nickel free batteries, low cost and longer life compared to NMC and other chemistries.”

“Lithium Werks BV is one of the leading LFP cell manufacturing companies globally and has a vast patent portfolio and a management team which brings the tremendous experience of innovation across LFP value chain. We are looking forward to working with the Lithium Werks team and are excited about the pace at which we are progressing towards establishing an end-to-end battery manufacturing and supply ecosystem for India markets,” Ambani added.

He concluded by saying “Along with Faradion, Lithium Werks will enable us to accelerate our vision of establishing India at the core of developments in global battery chemistries and help us provide a secure, safe and high-performance supply chain to the large and growing Indian EV and Energy Storage markets,”

Co-founder and CEO of Lithium Werks , Joe Fisher, said that this deal means increased resources and expanded global reach while leveraging their experienced team IP portfolio and providing scale and momentum to help drive product innovation, capacity expansion and accelerate the clean energy strategy.

Batteries of Lithium Werks are used in industrial, medical, marine, energy storage, commercial transportation and other highly demanding applications.

The acquisition is subject to certain regulatory and other customary closing conditions and is expected to complete by June 2022.

Also Read: RIL-Sanmina Join Hands For Flagship Production Unit in Chennai